Janine Guillot

CEO, The SASB Foundation

At the Sustainability Accounting Standards Board (SASB), we have long worked to illuminate the important interconnections between sustainability issues and business outcomes. We’re pleased to be joined in that effort by approximately 120 chief executive officers from many of the world’s largest and most influential companies.

At the World Economic Forum’s (WEF) Sustainable Development Impact Summit last week, the International Business Council (IBC) released its final recommendations for a core set of sustainability disclosures to be included in the mainstream annual reports of companies around the world. They include metrics from SASB Standards in addition to disclosures from the Climate Disclosure Standards Board (CDSB) Framework, the Global Reporting Initiative (GRI) Standards, the Task Force on Climate-related Financial Disclosures (TCFD) recommendations, and more. This is an important reflection of the IBC’s commitment to, as the report says, “amplifying the rigorous work already done by standard-setters rather than reinventing the wheel.”

SASB applauds this effort, which will significantly accelerate progress toward a globally accepted system of corporate reporting—one that presents a coherent, comprehensive view of financial and sustainability performance. In fact, to this end, the IBC’s report references the joint work of “the group of five” frameworks and standards-setters, which includes CDP (formerly the Carbon Disclosure Project), CDSB, GRI, the International Integrated Reporting Council (IIRC) and SASB. As the IBC points out, the efforts of the “group of 5” and its own initiative are “fundamentally complementary.”

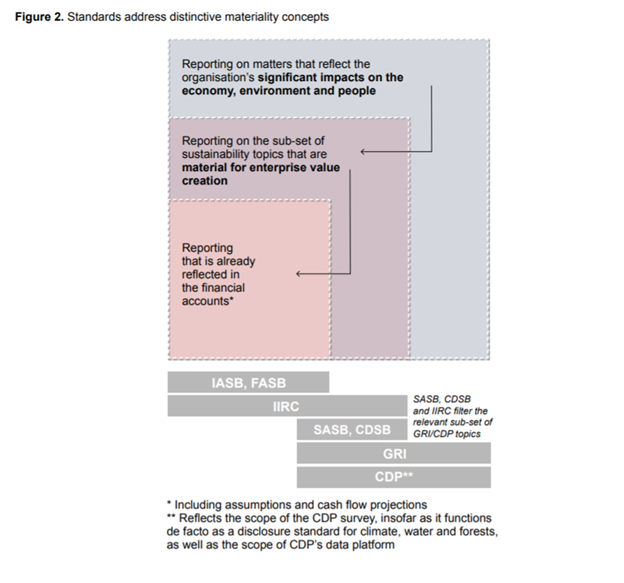

In our recent joint paper, Statement of Intent to Work Together Towards Comprehensive Corporate Reporting, the five collaborating organisations advanced a shared vision of the elements necessary for a comprehensive system of disclosure. Collectively, our organisations believe our frameworks and standards complement Financial GAAP and provide the natural starting point for progress toward such a system. We also believe our collaborative effort will help realise the IBC’s stated objective “to encourage greater cooperation and alignment among existing standards as well as to catalyze progress towards a systemic solution, such as a generally accepted international accounting standard in this respect.”

It is important to note that the IBC’s recommendations, titled “Measuring Stakeholder Capitalism,” are focused by design on establishing metrics to help a broad range of users better understand an organisation’s significant impacts on the economy, the environment, and people. This information is of interest to a broad range of stakeholders, including policymakers, consumers, employees, investors, and civil society organisations. As such, the IBC’s recommended set of stakeholder capitalism metrics consist of universally applicable, industry-agnostic indicators that help measure companies’ contributions to sustainable development and the Sustainable Development Goals.

However, as the group of five has pointed out in our recent paper (see an excerpted visual above), the information needs of one set of decision makers—specifically, participants in global capital markets—for information explicitly connected to enterprise value creation are equally important. These users need metrics that capture the industry-specific risks and opportunities that companies face in managing their performance. Such disclosure provides companies and investors with comparable information among industry peers on how they are managing the sustainability issues most likely to impact a firm’s financial condition, operating performance, or cost of capital. This focus on “financial materiality” is why SASB’s industry-specific standards are supported by global investors with approximately $55 trillion in assets under management, including many of the world’s largest asset managers and asset owners.

As WEF Managing Director Rick Samans told us in February, “The Forum’s IBC effort is not intended to replace or displace the industry-specific ESG metrics that investors need and that markets have begun to coalesce around. These are complementary and mutually reinforcing—not competing—initiatives.” Indeed, the IBC’s report acknowledges the group of five’s joint vision and commitment to “building the more integrated, international corporate reporting system that is advocated by the IBC and other interested parties.”

As we’ve said elsewhere, social well-being, a healthy environment, and economic prosperity are not mutually exclusive ambitions. Identifying and measuring the issues where the interests of business, investors and society overlap introduces win-win opportunities to deliver mutually beneficial value. That’s SASB’s aim, and we welcome the efforts of WEF and the IBC to achieve this vision.

Janine Guillot is CEO of the SASB Foundation.