Market input plays an invaluable role in shaping SASB Standards. Similarly, the perspectives of investors and companies around the world help us ensure our positions on key market developments are consistent with those of the constituencies we aim to serve. A case in point is the IFRS Foundation’s consultation on “sustainability reporting,” which remains open through Dec. 31.

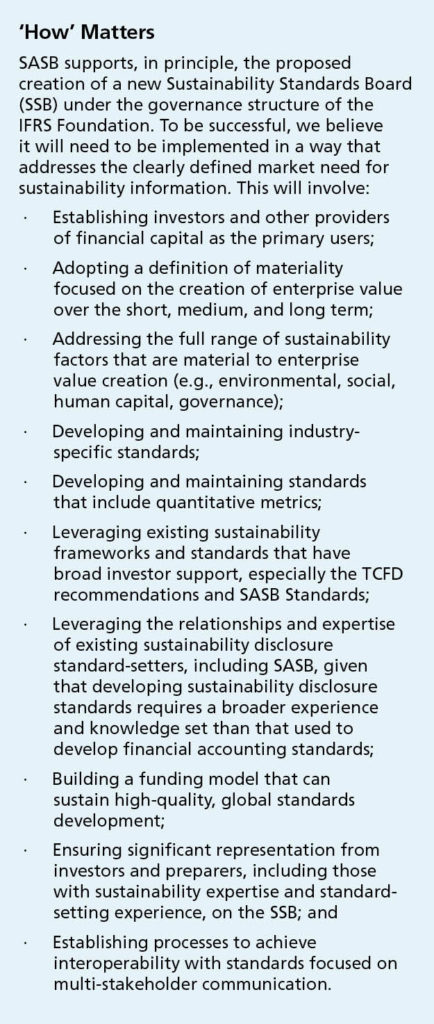

This week, we formally responded to the IFRS Foundation after soliciting feedback on our preliminary views. Although the broad brushstrokes haven’t changed, market input helped us sharpen our thinking on key details—for example, the importance of including significant investor representation on the proposed Sustainability Standards Board (SSB) and its governing bodies, the need to emphasise that investors and other providers of financial capital require sustainability disclosure that is comparable within an industry context, and the critical stipulation that the SSB take up and build on existing initiatives—such as SASB’s Standards, Conceptual Framework, and due process—rather than “reinventing the wheel.”

The feedback we received from market participants also made clear that we need to reiterate this important point: The IFRS Foundation’s proposal and the merger of SASB and the International Integrated Reporting Council (IIRC) into the Value Reporting Foundation (VRF) are not competing initiatives—quite the opposite. By merging two organisations focused on enterprise value creation, we hope to clarify and simplify the field. The VRF stands ready to engage with the efforts of the IFRS Foundation and others working toward global alignment on a corporate reporting system.

We believe the proposed creation of a new SSB under the IFRS Foundation can—and should—adopt, amend, and maintain the work of existing organisations either by hiring its own professional staff with sustainability expertise, by bringing in-house the expertise of the existing standard-setting organisations, or by contracting with those standard setters. In this way, the IFRS Foundation can establish authority and legitimacy around sustainability disclosure standards for capital markets, just as it did for financial reporting. Leveraging the work of existing organisations would enable the Foundation to strike a crucial balance between delivering a timely solution and maintaining rigorous due process.

Although we place critical importance on the details of how it is implemented, SASB is encouraged to see that we are not alone in expressing general support for the IFRS Foundation’s proposal. Thus far, more than 60 respondents have submitted formal responses, with overwhelmingly positive views regarding the proposal and strong support for the “building blocks” approach outlined in our Statement of Intent with CDP, the Climate Disclosure Standards Board (CDSB), the Global Reporting Initiative (GRI), and the International Integrated Reporting Council (IIRC).

For too long, the “competing initiatives” narrative has sown confusion, held up progress, and encouraged jurisdictional fragmentation. It’s time to put it to rest. With the right approach, the IFRS Foundation’s proposal can do just that, leveling the global playing field in a way that helps investors make more informed decisions and businesses deliver long-term value that benefits not only capital markets participants but the world at large.

Janine Guillot is CEO of SASB.