SASB standards are shaped in large part by the invaluable input we receive from companies, investors, and other key market participants. The feedback loops built into our due process ensure the standards are cost-effective for companies to implement and the information they yield is decision-useful for investors. In addition to these benefits, our ongoing engagement with the market also generates additional insights that enable SASB to take a similar, user-centred approach to creating resources that support the standards.

Our recently released TCFD Implementation Guide is the latest example. Developed alongside our colleagues at the Climate Disclosure Standards Board (CDSB), the guide is specifically designed to address feedback both organisations have received during consultations with reporting companies. Although more than 630 organisations have publicly expressed support for the recommendations of the Task Force on Climate-Related Financial Disclosures (TCFD), far fewer have followed through with TCFD-aligned reporting to investors. The companies we’ve spoken with have explained this “implementation gap” by noting a lack of practical guidance for putting the recommendations to use.

More specifically, these engagements with reporting companies have been characterized by a common refrain: “Show us what effective [climate-related] disclosure looks like.” With the TCFD Implementation Guide, we’ve attempted to do just that.

In preparing the guide, we developed mock TCFD-aligned reports from hypothetical companies by drawing from a wide range of real-world disclosures to present an authentic snapshot of what constitutes “good practice” reporting in 2019. Because climate change impacts every industry in unique ways, we endeavored to demonstrate a variety of considerations by covering three different SICS™ industries across the four core elements of the TCFD recommendations: governance, strategy, risk management, and metrics and targets (see Figure 1).

- OilCo is an integrated oil and gas company with global operations primarily in the Oil & Gas – Exploration & Production industry (EM-EP).

- AgriCo is a global player in the Agricultural Products industry (FB-AG) engaged in processing, trading, and distributing vegetables and fruits, and producing and milling agricultural commodities such as grains, sugar, consumable oils, maize, soybeans, and animal feed.

- AutoCo, operating in the Automobiles industry (TR-AU), is a global manufacturer of passenger vehicles, light trucks, and motorcycles.

These mock disclosures not only demonstrate what companies’ climate-related reporting might look like, they are also accompanied by detailed annotations to illustrate how the SASB standards and CDSB Framework can support and enhance TCFD implementation. The mock disclosures’ use of SASB standards, in particular, highlights how industry-specific performance metrics are an essential element of TCFD reporting—not only for fulfilling the Metrics & Targets recommendations, but for shedding light on the effectiveness of the other three core elements in driving measurable results. Although mock disclosures were prepared for the three industries noted above, they were designed to be useful for practitioners in any industry. The provided annotations illuminate the manner in which the SASB standards and CDSB Framework can be leveraged to enhance a company’s TCFD implementation by any company in any industry.

Download the TCFD Implementation Guide to read the full SASB- and CDSB-specific annotation that corresponds with each shaded number.

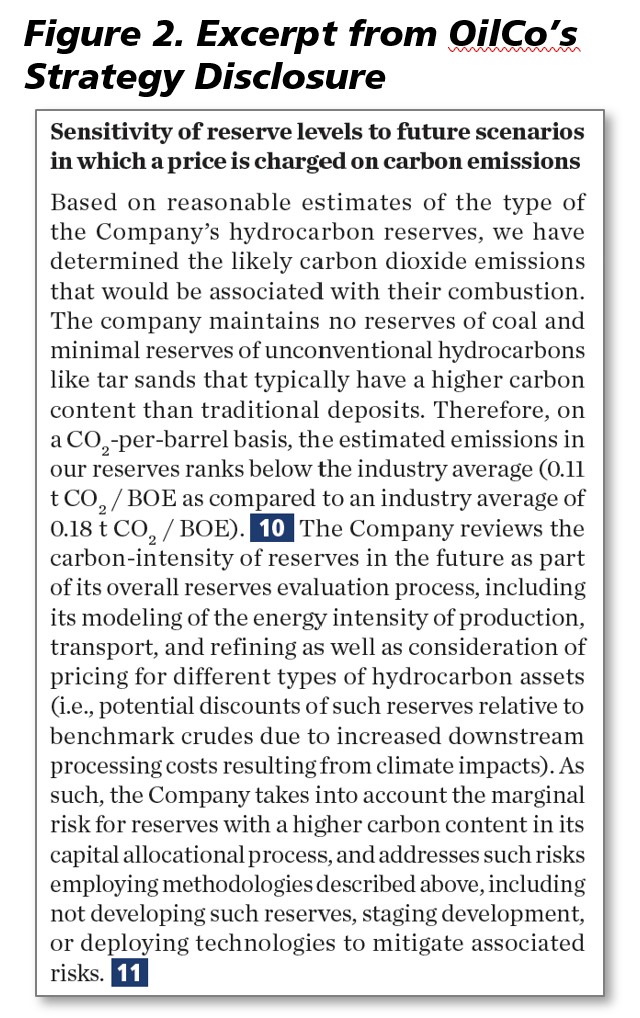

To help illustrate this point, an excerpt of OilCo’s Strategy disclosure has been included. Here, OilCo discusses its strategies to mitigate its Scope 1 emissions and shift its asset mix toward less carbon-intensive resources (see Figure 2).

By using key SASB metrics in its Strategy and Metrics & Targets disclosures, the company helps investors, lenders, and underwriters better understand the effectiveness of that strategy and the rationale behind management’s outlook.

For example, in Figure 2, the company uses SASB metric EM-EP-420a.2 to report the estimated CO2 emissions embedded in its reserves, providing visibility into the assumptions underlying its scenario analysis. Later in the disclosure, OilCo uses SASB metric EM-EP-420a.1 to disclose data on the sensitivity of its hydrocarbon reserve levels to future price projection scenarios that account for a price on carbon emissions. This information enables investors to make a more robust forward-looking assessment of the company’s discussion (per SASB metric EM-EP-420a.4) of how changes in price, demand, and regulation may influence its capital expenditure strategy for exploration, acquisition, and development of assets.

Meanwhile, in Figure 3, OilCo discloses quantitative performance data on its gross global Scope 1 emissions (SASB metric EM-EP-110a.1) and a breakdown of those emissions by source (EM-EP-110a.2). This information enables investors to better understand the effectiveness thus far of the company’s mitigation strategies to reduce its direct emissions. Collectively, the full set of industry-specific, climate-related SASB metrics facilitate a more informed assessment of the resilience of the company’s business model with respect to the transition to a climate-constrained economy, as well as comparison and benchmarking against peer organisations.

As these examples show, both forward-looking risk metrics and backward-looking performance metrics can substantially strengthen an organization’s Strategy disclosures (or its Governance or Risk Management disclosures) by illuminating the effectiveness of its strategic risk responses and oversight in driving measurable performance. Such disclosure provides investors with a more complete picture of the strategic tools companies are employing to manage and mitigate climate risk within an industry, as well as whether those tools are being effectively utilised to deliver results.

As these examples show, both forward-looking risk metrics and backward-looking performance metrics can substantially strengthen an organization’s Strategy disclosures (or its Governance or Risk Management disclosures) by illuminating the effectiveness of its strategic risk responses and oversight in driving measurable performance. Such disclosure provides investors with a more complete picture of the strategic tools companies are employing to manage and mitigate climate risk within an industry, as well as whether those tools are being effectively utilised to deliver results.

It’s equally valuable to recognize that if these metrics were reported without an accompanying discussion of the organization’s strategy for achieving its related performance targets, data could be construed as incidental and targets as arbitrary. By establishing clear links with the TCFD’s other core elements, a company’s performance on such metrics can help investors better assess the effectiveness of its strategies to mitigate key climate-related risks or capture emerging opportunities. In this way, the four core elements of the TCFD recommendations are mutually reinforcing. For example, readers of the guide will also see how OilCo’s risk management process ensures the forward resilience of its strategy, and how its governance provides effective oversight.

Companies increasingly recognise the value of strengthening and communicating how they approach the oversight, strategic consideration, measurement, and management of climate-related risks and opportunities. What we have heard is that the market would benefit from examples of effective disclosure to support companies in their efforts to move forward. In response, we developed the TCFD Implementation Guide as a practical tool that companies can use, alongside SASB’s and CDSB’s existing, market-tested resources, to fulfil the TCFD recommendations. We invite corporate reporting professionals to download the guide, along with the SASB standards for their industry and the CDSB Framework, and take the lead in meeting an urgent need by providing global capital markets with robust, clear, comparable, and useful climate-related disclosure.