SASB Standards are an important tool for ISSB disclosure

Sustainability factors are becoming a mainstream part of investment decision-making and companies are increasingly called upon to provide high-quality, globally comparable information on sustainability-related risks and opportunities.

SASB and others consolidated to help form a global baseline of sustainability disclosures

Recognising the value of existing frameworks and the market demand for streamlining, the International Sustainability Standards Board (ISSB) builds on and consolidates the work of market-led investor-focused reporting initiatives, including:

- SASB Standards

- Task Force for Climate-related Financial Disclosures (TCFD) Recommendations

- Integrated Reporting Framework

- Climate Disclosure Standards Board (CDSB) Framework

The ISSB develops IFRS Sustainability Disclosure Standards designed to meet investor information needs and enable companies to communicate decision-useful information efficiently to global capital markets.

The ISSB is committed to delivering standards that are cost-effective, decision-useful and market informed. Its work is backed by the G7, the G20, the International Organization of Securities Commissions (IOSCO), the Financial Stability Board, African Finance Ministers and Finance Ministers and Central Bank Governors from more than 40 jurisdictions.

The first two ISSB Standards, IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information (IFRS S1) and IFRS S2 Climate-related Disclosures (IFRS S2) are effective for reporting periods beginning after 1 January 2024.[1]

Industry-based guidance is integral to the ISSB Standards

“Industry-based sustainability disclosure standards – because they are focused on the drivers of risk and return most relevant to business models in a given industry – both improve comparability across companies and help reduce the burden to reporting companies.”

– SASB Standards Investor Advisory Group letter to the ISSB, May 2022

Investors want both cross-industry and industry-specific disclosures because some information is needed for comparison across all industries and regardless of business model – such as governance of climate risk – while other information is more decision useful when it is industry specific.

The 77 industry-based SASB Standards provide useful, comparable information to investors and are cost-efficient for companies, as evidenced by their use in over 3,100 companies in more than 80 jurisdictions around the world, including 75% of the S&P Global 1200 Index.

Therefore, the ISSB’s Standards require industry-specific disclosures, and companies are required to refer to and consider the SASB Standards to identify sustainability-related risks, opportunities and related metrics.

This means that companies already applying the SASB Standards are in a prime position to apply the first two ISSB Standards.

SASB Standards are a useful tool for implementation of ISSB Standards

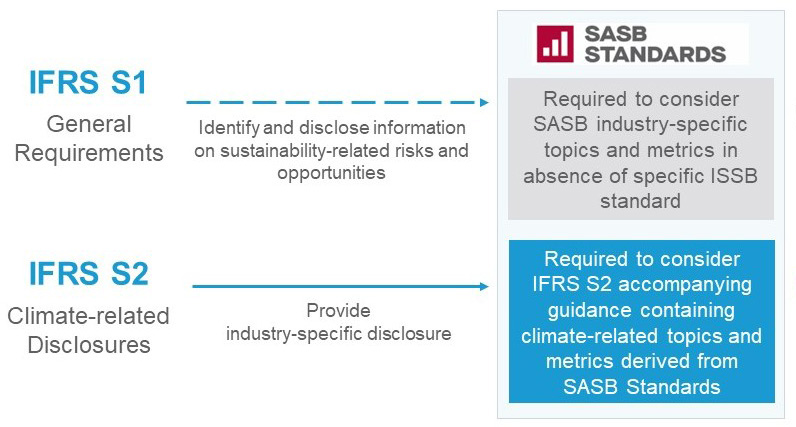

Think of IFRS S1 as an outline: the overarching standard that applies to all sustainability-related risks and opportunities but does not specify what those risks and opportunities are. To help companies identify their sustainability-related risks and opportunities and provide appropriate disclosures using IFRS S1, companies will be required to consider the SASB Standards for topics beyond climate.

Click here to view ISSB educational material explaining how companies can refer to and consider the content of the SASB Standards to meet the requirements in IFRS S1.

Role of SASB Standards in IFRS S1 and IFRS S2

IFRS S2 requires disclosure of material information about climate-related risks and opportunities to meet investor information needs. Used in accordance with IFRS S1, IFRS S2 requires industry-specific disclosures and include illustrative guidance for industry-specific, climate-related metrics derived from the SASB Standards.

When IFRS S1 is used in combination with IFRS S2 and other materials including the SASB Standards, companies can provide investors with the information they need about sustainability-related risks and opportunities. IFRS S1 and IFRS S2 also fully incorporate the TCFD Recommendations.

Companies applying the SASB Standards and the TCFD Recommendations will be well prepared to apply IFRS S1 and IFRS S2. The ISSB will maintain and enhance the SASB Standards throughout their continued existence and actively encourages preparers and investors to continue using them on the path to adoption of ISSB Standards.

Learn more about the ISSB and the IFRS Sustainability Disclosure Standards.

Learn about ISSB updates to the SASB Standards.

Download the SASB Standards.

[1] Early adoption is permitted but must be disclosed. Various transition reliefs are available, including the ability for a company to report on only climate-related risks and opportunities (as set out in IFRS S2) in the first year it applies IFRS S1 and IFRS S2.